Payment Notice – Vehicle Registration: Public Transit

Following collection agreements concluded with the Ministère des Transports et de la Mobilité durable and municipal partners, the SAAQ collects funds on behalf of these organizations. These transferred funds are used to finance public transit.

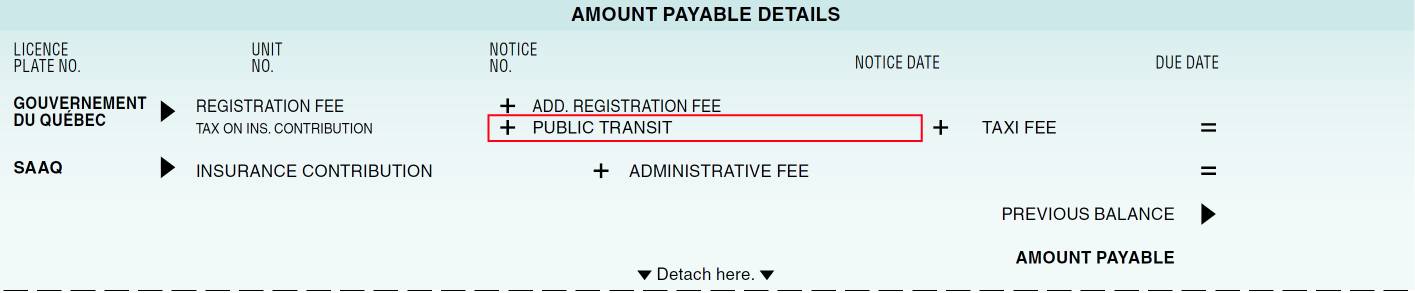

Additional amount on your payment notice

When you receive your vehicle registration payment notice, depending on where you live, you may see an additional amount called “Public Transit.” This amount may be split into two parts:

- The passenger vehicle registration tax (TIV). The amount varies based on where you live (refer to this table to see the applicable amounts in your region).

- A public transit contribution of $30. This amount is collected in regions served by a public transit body.

Based on where you live, you may have to pay both fees, one of the fees, or neither.

For more information or to file a complaint:

For the passenger vehicle registration tax, contact one of the organizations below, depending on where you live:

- For more information about the $30 public transit contribution, visit the Ministère des Transports et de la Mobilité durable website, or contact Québec 511 to obtain further information or file a complaint.

Amounts collected

2026

Refer to the table below for the public transit contribution and passenger vehicle registration tax applicable in your municipality as of January 1, 2026:

| Municipality | Public transit contribution | Vehicle registration tax | Organization responsible for the vehicle registration tax |

|---|---|---|---|

| Baie-d'Urfé | $30 | $153,45 | CMM |

| Beaconsfield | $30 | $153,45 | CMM |

| Beauharnois | $30 | $153,45 | CMM |

| Beloeil | $30 | $153,45 | CMM |

| Blainville | $30 | $153,45 | CMM |

| Boisbriand | $30 | $153,45 | CMM |

| Bois-des-Filion | $30 | $153,45 | CMM |

| Boucherville | $30 | $153,45 | CMM |

| Brossard | $30 | $153,45 | CMM |

| Calixa-Lavallée | - | $153,45 | CMM |

| Candiac | $30 | $153,45 | CMM |

| Cantley | $30 | - | - |

| Carignan | $30 | $153,45 | CMM |

| Chambly | $30 | $153,45 | CMM |

| Charlemagne | $30 | $153,45 | CMM |

| Châteauguay | $30 | $153,45 | CMM |

| Chelsea | $30 | - | - |

| Contrecœur | $30 | $153,45 | CMM |

| Côte-Saint-Luc | $30 | $153,45 | CMM |

| Delson | $30 | $153,45 | CMM |

| Deux-Montagnes | $30 | $153,45 | CMM |

| Dollard-des-Ormeaux | $30 | $153,45 | CMM |

| Dorval | $30 | $153,45 | CMM |

| Gatineau | $30 | $90 | Ville de Gatineau |

| Hampstead | $30 | $153,45 | CMM |

| Hudson | $30 | $153,45 | CMM |

| L'Ancienne-Lorette | $30 | - | - |

| L'Assomption | $30 | $153,45 | CMM |

| L'Île-Cadieux | - | $153,45 | CMM |

| L'Île-Dorval | $30 | $153,45 | CMM |

| L'Île-Perrot | $30 | $153,45 | CMM |

| La Prairie | $30 | $153,45 | CMM |

| Laval | $30 | $153,45 | CMM |

| Léry | $30 | $153,45 | CMM |

| Les Cèdres | - | $153,45 | CMM |

| Lévis | $30 | - | - |

| Longueuil | $30 | $153,45 | CMM |

| Lorraine | $30 | $153,45 | CMM |

| Mascouche | $30 | $153,45 | CMM |

| McMasterville | $30 | $153,45 | CMM |

| Mercier | $30 | $153,45 | CMM |

| Mirabel | $30 | $153,45 | CMM |

| Mont-Royal | $30 | $153,45 | CMM |

| Mont-Saint-Hilaire | $30 | $153,45 | CMM |

| Montréal | $30 | $153,45 | CMM |

| Montréal-Est | $30 | $153,45 | CMM |

| Montréal-Ouest | $30 | $153,45 | CMM |

| Notre-Dame-de-l'Île-Perrot | $30 | $153,45 | CMM |

| Oka | - | $153,45 | CMM |

| Otterburn Park | $30 | $153,45 | CMM |

| Pincourt | $30 | $153,45 | CMM |

| Pointe-Calumet | $30 | $153,45 | CMM |

| Pointe-Claire | $30 | $153,45 | CMM |

| Pointe-des-Cascades | - | $153,45 | CMM |

| Prévost | - | $37,70 | MRC de la Rivière-du-Nord |

| Québec | $30 | $60 | Ville de Québec |

| Repentigny | $30 | $153,45 | CMM |

| Richelieu | $30 | $153,45 | CMM |

| Rosemère | $30 | $153,45 | CMM |

| Saguenay | $30 | - | - |

| Saint-Amable | $30 | $153,45 | CMM |

| Saint-Augustin-de-Desmaures | $30 | - | - |

| Saint-Basile-le-Grand | $30 | $153,45 | CMM |

| Saint-Bruno-de-Montarville | $30 | $153,45 | CMM |

| Saint-Colomban | - | $37,70 | MRC de la Rivière-du-Nord |

| Saint-Constant | $30 | $153,45 | CMM |

| Saint-Eustache | $30 | $153,45 | CMM |

| Saint-Hippolyte | - | $37,70 | MRC de la Rivière-du-Nord |

| Saint-Isidore | - | $153,45 | CMM |

| Saint-Jean-Baptiste | - | $153,45 | CMM |

| Saint-Jérôme | $30 | $153,45 | CMM |

| Saint-Joseph-du-Lac | $30 | $153,45 | CMM |

| Saint-Lambert | $30 | $153,45 | CMM |

| Saint-Lazare | $30 | $153,45 | CMM |

| Saint-Mathias-sur-Richelieu | $30 | $153,45 | CMM |

| Saint-Mathieu | - | $153,45 | CMM |

| Saint-Mathieu-de-Belœil | - | $153,45 | CMM |

| Saint-Philippe | $30 | $153,45 | CMM |

| Saint-Sulpice | $30 | $153,45 | CMM |

| Sainte-Anne-de-Bellevue | $30 | $153,45 | CMM |

| Sainte-Anne-des-Plaines | $30 | $153,45 | CMM |

| Sainte-Catherine | $30 | $153,45 | CMM |

| Sainte-Julie | $30 | $153,45 | CMM |

| Sainte-Marthe-sur-le-Lac | $30 | $153,45 | CMM |

| Sainte-Sophie | - | $37,70 | MRC de la Rivière-du-Nord |

| Sainte-Thérèse | $30 | $153,45 | CMM |

| Senneville | $30 | $153,45 | CMM |

| Sherbrooke | $30 | $34,75 | Ville de Sherbrooke |

| Terrasse-Vaudreuil | $30 | $153,45 | CMM |

| Terrebonne | $30 | $153,45 | CMM |

| Trois-Rivières | $30 | - | - |

| Varennes | $30 | $153,45 | CMM |

| Vaudreuil-Dorion | $30 | $153,45 | CMM |

| Vaudreuil-sur-le-Lac | - | $153,45 | CMM |

| Verchères | $30 | $153,45 | CMM |

| Westmount | $30 | $153,45 | CMM |

| Wôlinak | $30 | - | - |

Passenger vehicle registration tax

The funds are collected on behalf of various municipalities and the Autorité régionale de transport métropolitain (ARTM) in accordance with the agreements concluded with the SAAQ. This contribution is non-refundable if a vehicle owner changes addresses. The SAAQ collects the passenger vehicle registration tax in the following regions:

Since January 1, 2024, owners of passenger vehicles registered in the Greater Montreal area (territory covered by the CMM) and Saint-Jérôme are required to pay a tax to finance public transit. For 2024, the CMM set the amount of the tax at $59. As of January 1, 2025, the amount is $150.

The SAAQ collects this tax with passenger vehicle registration payments and remits it to the Autorité régionale de transport métropolitain (ARTM).

For owners of vehicles registered in the municipalities concerned, this tax is in addition to the public transit contribution and cannot be reimbursed in the event of a change of address. For information or to file a complaint, contact the ARTM .

As of January 1, 2025, owners of passenger vehicles registered in the MRC de La Rivière-du-Nord are required to pay a tax to finance public transit. Although Saint-Jérôme is part of the MRC, owners of passenger vehicles registered in Saint-Jérôme are subject to the tax charged by the CMM instead of the MRC.

The SAAQ will collect this tax with passenger vehicle registration payments and will remit it to the MRC de La Rivière-du-Nord.

This tax cannot be reimbursed in the event of a change of address.

For information or to file a complaint, contact the MRC de La Rivière-du-Nord .

As of January 1, 2025, owners of passenger vehicles registered in Sherbrooke are required to pay a tax to finance public transit.

The SAAQ will collect this tax with passenger vehicle registration payments and will remit it to the city of Sherbrooke.

This tax is in addition to the public transit contribution and cannot be reimbursed in the event of a change of address.

For information or to file a complaint, contact the Ville de Sherbrooke .

As of January 1, 2025, owners of passenger vehicles registered in Gatineau are required to pay a tax to finance public transit.

The SAAQ will collect this tax with passenger vehicle registration payments and will remit it to the city of Gatineau.

This tax is in addition to the public transit contribution and cannot be reimbursed in the event of a change of address.

For information or to file a complaint, contact the Ville de Gatineau .

As of January 1, 2025, owners of passenger vehicles registered in the city of Québec are required to pay a tax to finance public transit.

The SAAQ will collect this tax with passenger vehicle registration payments and will remit it to the city of Québec.

This tax is in addition to the public transit contribution and cannot be reimbursed in the event of a change of address.

For information or to file a complaint, contact the Ville de Québec .

Public transit contribution

Since 1992, owners of passenger vehicles registered in certain municipalities are required to pay a public transit contribution.

The SAAQ collects this contribution with vehicle registration payments and remits it to the Ministère des Transports et de la Mobilité durable for distribution to the appropriate public transit authority.

This contribution is non-refundable if a vehicle owner changes addresses.

Last update: January 5, 2026